I Sure Am Glad There's No Inflation

August 5, 2015

I sure am glad there's no inflation, because these "stable prices" the Federal Reserve keeps jaw-jacking about are putting us in a world of hurt.

We are constantly bombarded with two messages about inflation:

1. Inflation is near-zero

2. This worries the Federal Reserve terribly, because stable prices are deflationary and deflation is (for reasons that are never explained) like the financial Black Plague that will wipe out humanity if it isn't vanquished by a healthy dose of inflation (i.e. getting less for your money).

Those of us outside the inner circles of power are glad there's no inflation, because we'd rather get more for our money (deflation) rather than less for our money (inflation). You know what I mean: the package that once held 16 ounces now only holds 13 ounces. A medication that once cost $79 now costs $79,000. (This is a much slighter exaggeration than you might imagine.)

Our excellent F-18 Super Hornet fighter aircraft cost us taxpayers $54 million a piece. Now the replacement fighter, the wallowing collection of defective parts flying in close proximity known as the F-35 costs $250 million each--unless you want an engine in it. That'll cost you extra, partner.

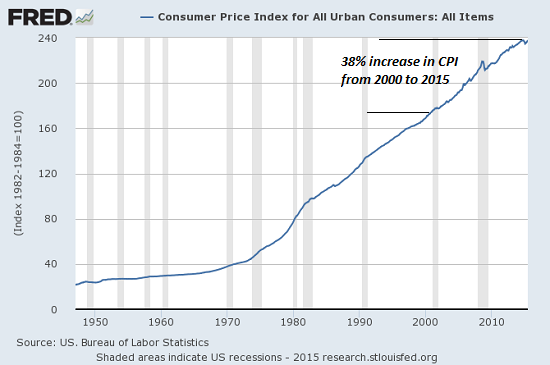

Despite all these widely known examples of rampant inflation, every month we're told there's no inflation. Just to reassure myself there's no inflation, I looked up a few charts on the St. Louis Fed's FRED database.

I have to say, I'm scratching my head here because the cost of things has gone up a lot since 2000.

The consumer price index is up 38% from 2000. Now if somebody were to give me a choice between getting 10 gallons of gasoline and 10 gallons minus 3.8 gallons of gasoline, I'd take the 10 gallons. So how the heck can a 38% increase be near-zero inflation?

If I took $38 of every $100 you earned, would you reckon I'd taken next to nothing from you? Do you earn 38% more than you did in 2000? If so, congratulations; most people can't answer "yes."

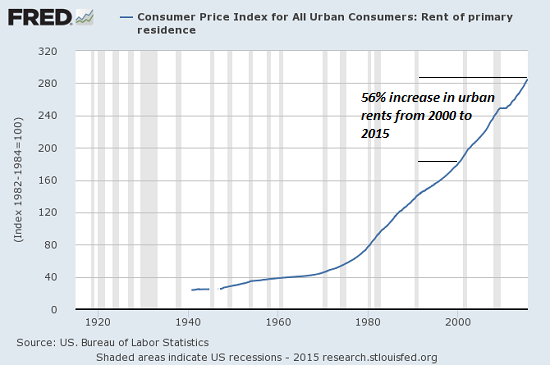

Urban-area rents are up 56% from 2000. Now this is even worse inflation, because you just paid $156 for what used to cost you only $100.

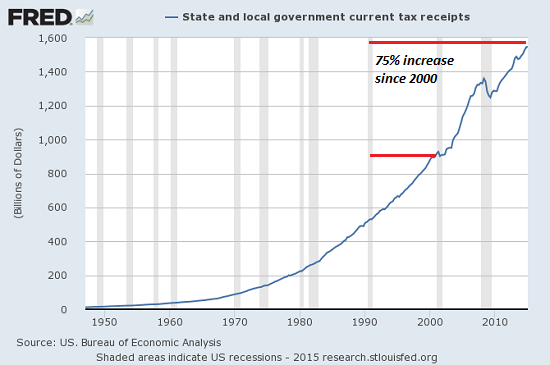

State and local government taxes are up 75% since 2000. And this doesn't even include the rip-off fishing license fees that have gone through the roof, the boat registration fees that have shot to the moon, and the legal-looting parking ticket that used to be $12 and is now $60.

Taxes naturally rise with the economic expansion due to rising population, which has gone up about 13.8% since 2000: from 281 million residents of the USA to 320 million in 2015. So taxes rising a few percentage points each year along with growth and population would make sense. But 75%?

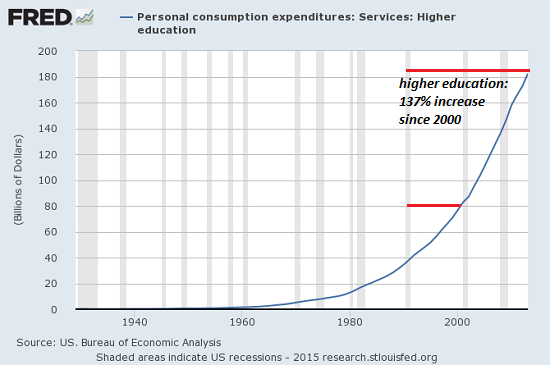

I've got a real treat for all you parents, uncles, aunts and grandparents who are planning to put the kids through college: the costs have only risen about 100% since 2000. That means instead of scraping up $80,000 per kid (assuming they can get all their required classes and grind the thing out in four years) you now need to scrape up $160,000 per kid.

The price index for college tuition grew by nearly 80 percent between August 2003 and August 2013. Now to make this apples to apples with the rest of the data here, we need to add in the nearly 5 missing years: from 1/1/2000 to 8/1/2003 and from 8/1/2013 to 8/1/2015. I'd say putting the increase at 100% is being conservative.

I sure am glad there's no inflation, because these "stable prices" the Federal Reserve keeps jaw-jacking about are putting us in a world of hurt. If we had honest-to-goodness inflation, that would push us right over the edge.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Julia B. ($50), for your courageously generous contribution to this site-- I am greatly honored by your steadfast support and readership. |