The Central Banks Face Unwelcome Realities: Their Policies Boosted Wealth Inequality and Failed to Generate "Growth"

February 3, 2017

Rather than be seen to be further enriching the rich, I think central banks will start closing the "free money for financiers" spigots.

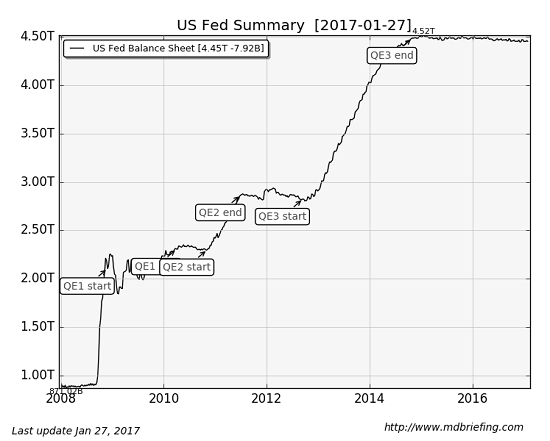

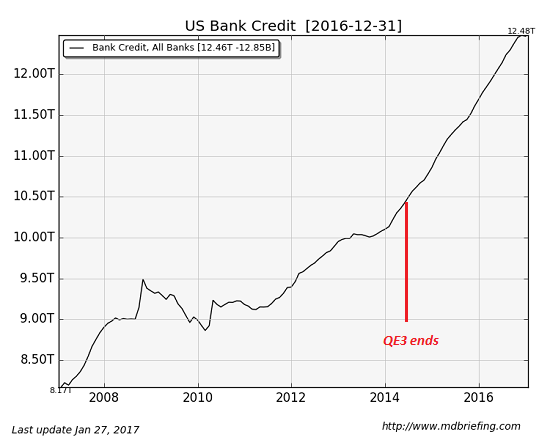

Take a quick glance at these charts of the Federal Reserve balance sheet and bank credit in the U.S. Notice what happened to bank credit after the Fed "tapered" and stopped expanding its balance sheet?

Bank credit exploded higher:

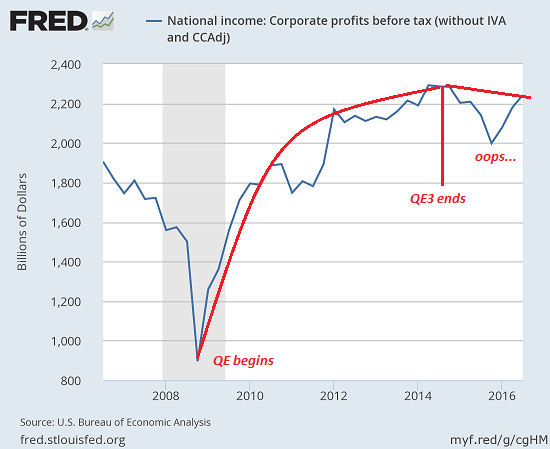

Now look at corporate profits:

Once the Fed ended its $3.7 trillion "experiment" of vastly expanding its money-creation and bond-buying in early 2014, what happened to bank credit? Bank credit had expanded by a bit over $1 trillion in the early years of the Fed's quantitative easing, but it really took off after QE3 ended, soaring roughly $2 trillion.

This was the policy goal all along: the Fed would do the heavy lifting to keep credit and the financial markets from imploding, and eventually private-sector credit would expand enough to fuel a self-sustaining recovery.

While measures of employment and production have lofted higher, productivity, profits and wages for the bottom 95% have all stagnated. Is it coincidental than corporate profits began weakening once the Fed's QE3 ended? Perhaps.

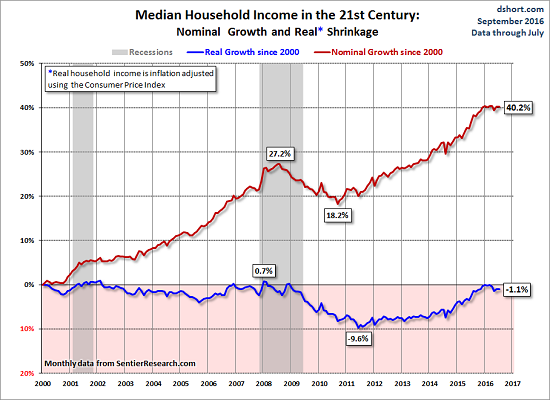

How about the stagnation of household median income during the Fed's expansion and the rise of private bank credit from 2014 to the present? Was that also a coincidence?

If the economy was expanding smartly as the Fed was goosing credit higher, it certainly wasn't trickling down to households.

What's happening beneath the happy-happy surface is that the returns on expanding credit are diminishing rapidly. The Fed's QE "free money for financiers" never did "trickle down" to the bottom 95%, and the enormous expansion of bank credit is no longer driving corporate profits higher.

There are other factors at work, of course; a global slowdown in trade, for example, a rise in energy costs and a stronger US dollar. All of these impact credit, profits and the share of GDP flowing to labor in wages, salaries and benefits.

Whatever the causes, the reality is that the positive results of credit expansion have reached the top of the S-curve and are now declining. Expanding credit, via central bank monetary policy or private-sector bank credit, is no longer boosting profits or wages.

As noted yesterday in The Central Banks Pull Back: Now It's Up to Fiscal Policy to "Save the World", even the cheerleaders of central bank gimmickry now admit QE enriched the rich and impoverished everone else.

So what happens as other central banks taper their expansion? It's unlikely to be a positive for private-sector economies stagnating despite rapid expansion of bank credit.

And what happens if central banks unleash new torrents of cash? If the returns on new credit have plummeted, rapid expansion by central banks may well hasten the slide down the S-curve-- the opposite of what conventional economists expect.

Rather than be seen to be further enriching the rich, central banks will start closing the "free money for financiers" spigots. If the returns on central bank "free money for financiers" are diminishing rapidly while public anger at rising wealth inequality is heating up, why put the central bank's credibility and political independence on the line for a policy that has visibly failed to benefit Main Street?

We discuss these trends and much more about the economy in

My podcast with X22: The Central Bankers Are Going To Shutoff The Spigot

And The Economy Will Rollover.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

Check out both of my new books, Inequality and the Collapse of Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle, $8.95 print). For more, please visit the OTM essentials website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, William H. ($50), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Stephen C. ($5/month), for your supremely generous subscription to this site -- I am greatly honored by your support and readership. |

Discover why Iím looking to retire in a SE Asia luxury resort for $1,200/month. |