(March 17, 2010)

Total credit in the U.S. has surpassed household net worth. We are

insolvent.

Total credit in the U.S. has surpassed household net worth. Without getting

too fancy--even without counting the gazillion dollars of derivatives floating

around, and all the off-balance accounting tricks of the banks, etc.--this is the

definition of insolvency (debts exceed assets).

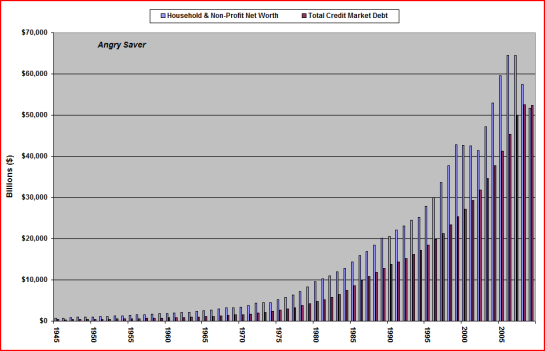

Astute correspondent Angry Saver submitted two charts for our review, and some

explanatory commentary.

In the new eCONomy, "Extra Credit" isn't what it used to be! Maybe that's because

"credit" is a warm and fuzzy name for DEBT!

With all the financial propaganda that's spewed about by the MSM, it's very easy

to lose sight of the big picture. With that in mind, I wanted to share two of my

charts with you.

The two charts compare two broad and distinct measures over time -

total credit market debt and total household & non-profit net worth.

I was trying to show the broadest debt/wealth picture possible and avoid comparisons

to GDP. In general, I think the focus on GDP (basically spending) misses the point

- the excessive level of debt in the system. Admittedly, it's an imperfect

comparison based on imperfect measures, but very telling nonetheless (imho anyway).

Hopefully the following will help clarify the charts. All data is from the Fed's Flow

of Funds tables.

Total credit market debt is a measure of ALL issued debt in the system

including state, local and federal government debt, household debt (mortgage, consumer,

etc.), non-financial business debt, financial debt and foreign debt. Social Security Trust funds

debts of ~ $ 5 trillion are NOT included as they are not marketable and explicit

debts of the U.S. Government.

Though not all-encompassing, Household and non-profit net worth is a broad

and widely recognized measure of a nation's net wealth, including real estate, plant,

equipment, stocks, bonds, etc. Wealth/resources such as national parks are not

measured/included.

(Off topic - the debt creators and wealth extractors are already

scheming to transform these types of shared and generally free wealth into rental

streams. Beware! The last thing we need is for banksters and CONgress critters

to transform existing and shared wealth into yet more unproductive debt. Grrrrrr!)

Our credit system is primarily based on collateral. So in a way, the charts show

how much collateral has been monetized and is available for monetization at a given

point in time. It's a dynamic system affected by many factors such as interest

rates and credit policies.

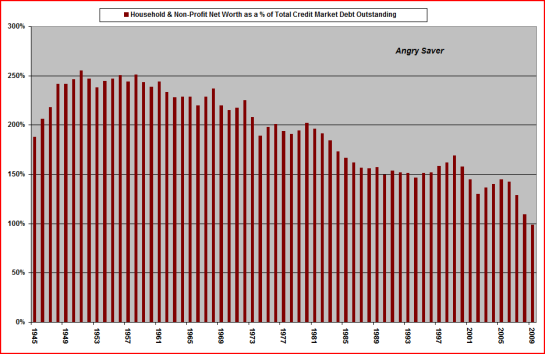

As the charts show, total credit market debt now exceeds total household net

worth for the first time! Note: I used an average of household net worth for

years 2008 & 2009 to dampen some of the huge swings in asset values. For all

other years the household net worth data is as of the end of Q4, per the Flow

of Funds. The averages I used for 2008 & 2009 made 2008 look slightly better

and 2009 slightly worse, but I think the averages are more representative of the

trend most people are experiencing. I also think the averages remove some of

the huge distortions created by the Fed and mark-to-fantasy accounting.

As a point of reference, at the end of Q1, 2009, household net worth was only

92% of total debt and falling fast! Is it any wonder Bernanke started

quantitatively (dis)easing and CONgress suspended mark to market accounting rules

in March of 2009? If a nation's issued debt exceeds the total net-wealth of

its citizens, exactly where is the collateral for more lending? Is it wise

to preserve trillions in unproductive and fraudulently issued debt?

Is it wise to allow a few members of the Fed to imbue so much un-earned wealth

and power to the issuers and holders of said debt?

So much for being the

wealthiest nation ever. Financial innovation? Please. A pyramid of ponzi debt.

In some circles, when the debt of a nation exceeds the wealth of the nation's people,

it means insolvency. Yeah, yeah, I know, it's a check book system....we

owe ourselves...financial debt is double counting. Bah! Hogwash!

For numerous reasons, our actual financial situation is much worse than shown in

the charts. For one, assets values are still very rich on a historical basis,

though low rates do offer support for current values. For another, the total

debt numbers do NOT include the ~ $5 trillion in trust fund debts for social

(in)security, etc. For yet another, tens of trillions of future medical and

retirement liabilities are not included either.

I could go on and on about competitiveness, demographics, wealth distribution,

etc., but there's no need.

As I see it, we don't just have a wealth distribution problem, we have TOO MUCH DEBT

relative to our wealth.

Maybe it's just me, but I find it very troubling that our Government is willing

to explicitly guarantee Wall St. bank debts and trillions in fraudulent Wall St.

credit, but they won't explicitly guarantee entitlements that people have been

paying taxes into for decades. Hank Paulson's recent op-ed in the WSJ claiming

we had to get a handle on entitlements should be a wake up call for the majority.

When a Wall St. operative like Paulson wants to "address" entitlements,

it likely means the majority are about to be short-changed. I'm not making a

judgment about whether or not we can afford all of the promised entitlements.

The point I am making is that the opinions of Paulson and all the other Wall

Street bailout recipients should be viewed very critically.

Credit creation in a fiat system is a privilege. Used wisely, credit can increase

output without inflation. Under the stewardship of venal bonus seeking bankers

like Paulson, the credit creation privilege was used to extract wealth rather than

create wealth. The Fed and their policy of inflation enabled Wall Street to

skim trillions from Main Street.

Decades of reckless credit creation, bubbles and shams. Cui bono? Hank

Paulson and Wall Street. Why would anyone value their opinions?

As always, comments and criticisms are welcomed.

Thank you, Angry Saver, for an excellent explanation of your sobering charts.

I know there are quibbles to be made about the balance sheet represented here.

Some will no doubt claim that Muir Woods, the Hoover Dam, the Strategic Oil Reserve,

etc., are worth trillions, but this is a pointless "feel-good" exercise because

the Federal government is not selling Muir Woods, the Hoover Dam,

and the Strategic Oil Reserve. (Local governments are however rapidly selling or leasing

their parking meters, toll roads, etc., in a desperate attempt to raise enough money

to fund their pension obligations for the next six months.)

The salient fact is that all public debt is a liability against taxpayers who have

to pay interest on that debt. The only "real" thing about the trillions in

public debt is the $450 billion the taxpayers spend on interest every year

(and that's just Federal debt, not state and local government bonds debt).

Even if someone were to conjure up $20 trillion in government-owned assets ("get your

world-class global Empire right here!"), as Angry Saver noted, you would also have

to include the future liabilities of Social Security, Medicare/Medicaid, Veterans

Administration benefits, etc., which are conservatively estimated at $60+ trillion.

And then there's the little matter of the $1.6 trillion Federal deficits piling up every year

until Doomsday.

I think a very strong case can be made that the real estate, stock and bond assets

of the U.S. are grossly overvalued, and once interest rates rise to more typical

levels (as they most assuredly will) then an easy $10 trillion will be instantly

shaved off the bloated valuations of all interest-rate-sensitive assets, which

include real estate, stocks and bonds.

Given the absurd overvaluations currently hidden by "marked-to-fantasy" assets

in bank balance sheets, I would guess we're actually $5 trillion in the hole right

now, were all assets instantly marked to market.

It is tiresome indeed to hear the constant exhortations of the Status Quo and the MSM

touting more debt as the solution to our "growth problem." Garsh, do you think the

"growth problem" might be causally linked to the "debt problem"?

We're bankrupt, Baby. The travesty of a mockery of a sham can be extended for

a time (at least until the November elections), but it cannot be extended indefinitely.

If you haven't visited the forum, here's a place to start. Click on the link

below and then select "new posts." You'll get to see what other oftwominds.com readers and

contributors are discussing/sharing.

DailyJava.net

is now open for aggregating our collective intelligence.

Order Survival+: Structuring Prosperity for Yourself and the Nation and/or

Survival+ The Primer

from your local bookseller or from amazon.com or in ebook

and

Kindle formats.

A 20% discount is available from the publisher.

Of Two Minds is now available via Kindle:

Of Two Minds blog-Kindle

"This guy is THE leading visionary on reality.

He routinely discusses things which no one else has talked about, yet,

turn out to be quite relevant months later."

--Walt Howard, commenting about CHS on another blog.

NOTE: contributions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

|

Thank you, Pam C. ($20), for your enduring support

of this site, and for all you do as a key member of The Remnant.

I am greatly honored by your support and readership.

|

|

Thank you, John R. ($40), for your many outrageously generous donations

to the site.

I am greatly honored by your support and readership.

|

Or send him coins, stamps or quatloos via mail--please

request P.O. Box address.

Your readership is greatly appreciated with or without a donation.

For more on this subject and a wide array of other topics, please visit

my weblog.

All content, HTML coding, format design, design elements and images copyright ©

2010 Charles Hugh Smith, All rights

reserved in all media, unless otherwise credited or noted.

I would be honored if you linked this wEssay to your site, or printed a copy for your own use.