When the "Solutions" Become the Problems

March 29, 2017

Those benefiting from these destructive "solutions" may think the system can go on forever, but it cannot go on when every "solution" becomes a self-reinforcing problem that amplifies all the other systemic problems.

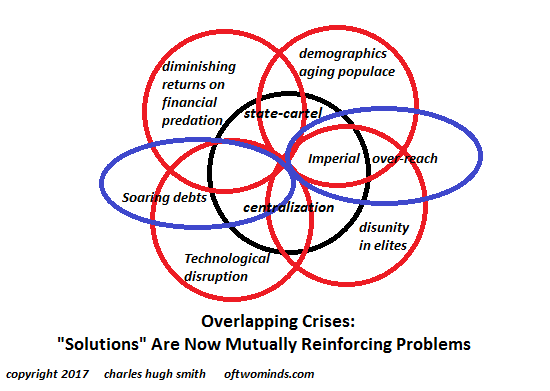

We are living in an interesting but by no means unique dynamic in which the solutions to problems such as slow growth and inequality have become the problems. This is a dynamic I have often discussed in various contexts. In essence, a solution that was optimized for an earlier era and situation is repeatedly applied to the present--but the present is unlike the past, and the old solution is no longer optimized to current conditions.

The old solution isn't just a less-than-optimal solution; it actively makes the problem worse.

As a result, the old solution becomes a new problem that only exacerbates the current difficulties. The status quo strategy is not to question the efficacy of the old solution--it is to apply the old solution in heavier and heavier doses, on the theory that if only we increase the dose, it will finally resolve the problem.

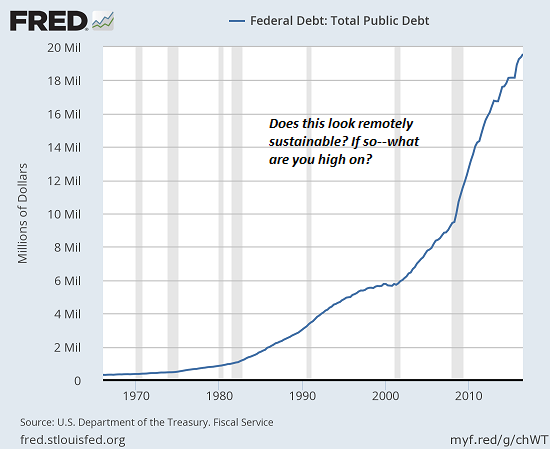

Take borrowing from the future, i.e. debt, as a prime example of this dynamic. Back when credit was scarce and expensive, unleashing a tsunami of cheap, abundant credit supercharged growth by enabling millions of people who previously had limited access to credit to suddenly borrow and spend enormous sums of cash.

This tsunami of new spending supercharged growth such that servicing the debt was easy, as incomes and wealth both expanded far beyond the cost of the new debt.

Fast-forward to today, and adding 50% of the nation's GDP in new federal debt ($9 trillion) and trillions more in corporate and houshold debt in the past 8 years has yielded subpar growth--roughly 2% a year.

This poor response to massive floods of credit, borrowing and spending has flummoxed conventional economists, who incorrectly assumed old solutions would always work as they had in the past.

In a similar fashion, conventional economists expected fiscal stimulus to boost growth. Fiscal stimulus--one-time tax refunds, infrastructure spending, tax cuts and various forms of "helicopter money"--central banks creating money out of thin air for the government to spend or distribute--have all failed to generate the self-sustaining virtuous cycle of boosting the output of the engines of income/wealth creation.

As I noted in Fragmentation and the De-Optimization of Centralization (January 2, 2017), The 4th Industrial Revolution has de-optimized centralization. Centralized control, power and money are now the problem, not the solution.

In the past, centralizing control of industries, credit and production increased the productivity of the whole economy. But that was then, and this is now. In the current era, centralization only breeds corruption, moral hazard, revolving doors between state agencies and private industry, opaque, rigged markets, rentier cartel parasitism and state-cartel crony capitalism, in which the central state regulates industries like Big Pharma, defense weaponry, higher education and so on to benefit entrenched interests, elites and cartels.

Regulations have also slipped from being solutions to problems. Everyone weighing the costs and benefits agrees that building and zoning codes enacted at the turn of the 19th century and the beginning of the 20th century greatly reduced the health hazards posed by slums and unregulated industries. Everyone weighing the costs and benefits agrees that clean air and water regulations imposed in the early 1970s benefited the public and the nation, despite the higher costs for goods and services that industry passed down to the consumer.

Technological improvements and efficiencies offset much or all of these costs by the 1980s, and by the 1990s, technological gains were increasing the income and wealth of almost every participant in the economy.

Recently, these technological gains have become concentrated in the top 5% of wage-earners and the owners of the capital. There are several drivers for this, including proximity to cheap credit, tax evasion techniques available only to corporations and the wealthy, pay-to-play lobbying for tax breaks and regulatory barriers to competition, and so on--all the foul fruits of centralized power and the crony-capitalism it breeds.

But technology is also exacerbating the trend to a winner-take-all or winners-take-most asymmetry between the most profitable and productive and "everyone else."

Regulations have now become burdens rather than low-cost means of improving the commons shared by all. Advocates for "tiny houses" and similar solutions to homelessness run into buzz-saws of regulations that prohibit such construction and zoning, and advocates of innovations from urban farming to crypto-currencies find regulations (often serving the interests of political donors rather than the public) are stifling innovations and efficiencies that would benefit the many rather than the few.

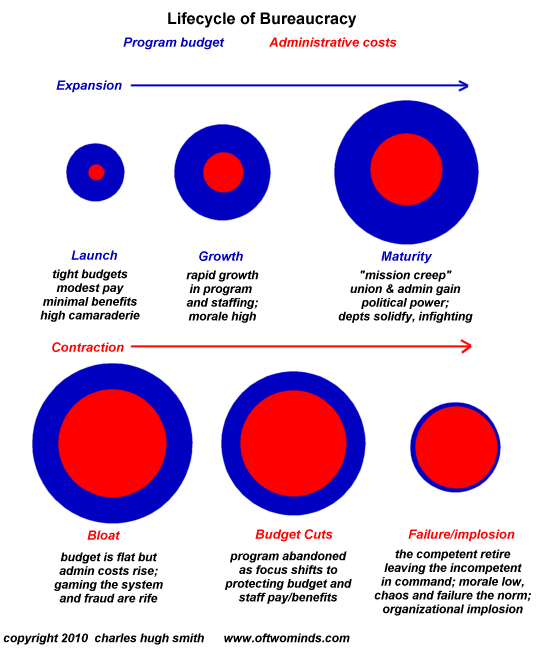

The regulatory agencies are prone to self-serving complexity that justified their budgets and power; as the regulations become more voluminous and arcane, "experts" in reading the runes and keeping up to date justify their big salaries and departmental budget.

The Lifecycle of Bureaucracy (December 2, 2010)

As I explain in my book Resistance, Revolution, Liberation: A Model for Positive Change, the state only knows how to expand; there is no mechanism, no institutional memory and no reward motivation to reduce the size of state power or revenues, or reduce the reach of the regulations and laws that empower the state to control virtually every aspect of life.

There are many other "solutions" that no longer solve their intended target problem but have become burdensome problems in themselves. One need only look at healthcare, higher education and weaponry acquisition programs to find hundreds of examples of perverse incentives and unintended consequences that are the direct result of anti-competitive, intentionally opaque, centralized regulations that are implicitly designed to benefit the few (wealthy political donors, lobbyists and entrenched interests) at the expense of the many who are shut out of the regulatory game.

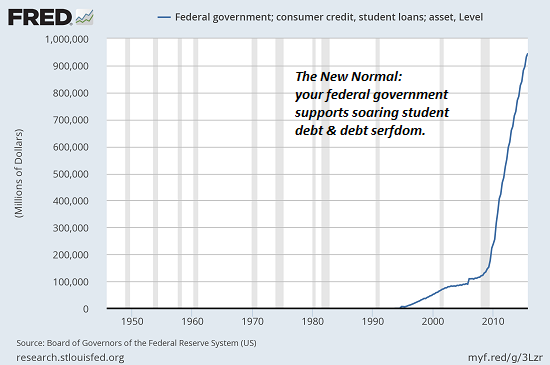

Student loans are an excellent example of a "solution" becoming a problem itself, while the underlying problem--soaring costs for diminishing-return diplomas--rages on, enabled by the "solution": force student debt-serfs to borrow another trillion dollars to fund sclerotic, self-serving bloated bureaucracies.

The Nearly Free University and the Emerging Economy: The Revolution in Higher Education.

Borrowing and spending $9 trillion did little but indenture future taxpayers to pay for for our massive malinvestment in diminishing-returns dead-ends.

If we look at yesterday's chart of overlapping crises, we note each crisis began as a purported "solution." The "solutions" are: more debt (now a problem); more centralization (now a problem); financialization (now a problem); promising more benefits to everyone (now a problem), and so on.

Real solutions are optimized for the 4th Industrial Revolution and the emerging economy, not the economy of 1946. These solutions are the opposite of all the institutional-state-cartel "solutions": decentralize power and control, transparency rather than self-serving obfuscation; empowerment of communities rather than centralized agencies and cartels, and embracing disruptive technologies--technologies that disrupt existing rentier skims, cartel rackets, regulatory barriers, etc.

The cold truth is all these institutional-state-cartel "solutions" serve the few at the expense of the many. This is not a side-effect; it is the intended output of these "solutions." In other words, these "solutions" work great for the parasitic few at the top skimming all the wealth, power and income, at the expense of the exploited many and the stability of the system as a whole.

Those benefiting from these destructive "solutions" may think the system can go on forever, but it cannot go on when every "solution" becomes a self-reinforcing problem that amplifies all the other systemic problems.

Recent podcasts/video programs:

Keiser Report: Jon Corzineís Big, Bad Bond Bet (25:43 min., 2nd half)

Self-Employment & Financial Bubbles (1:26 hrs)

Charles Hugh Smith On Inequalities And The Distortions Caused By Central Bank Policies (30 min.)

Rogue Money (56:59 min.)

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

Check out both of my new books, Inequality and the Collapse of Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle, $8.95 print). For more, please visit the OTM essentials website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Jose S. ($200), for your beyond-outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Kristi I. ($50), for your supremely generous contribution to this site -- I am greatly honored by your support and readership. |

Discover why Iím looking to retire in a SE Asia luxury resort for $1,200/month. |