|

|

Labored Daze September 1, 2025

In the labored daze of AI hype and GDP "growth," few seem to notice the workforce is tired of being exploited as an uncomplaining resource.

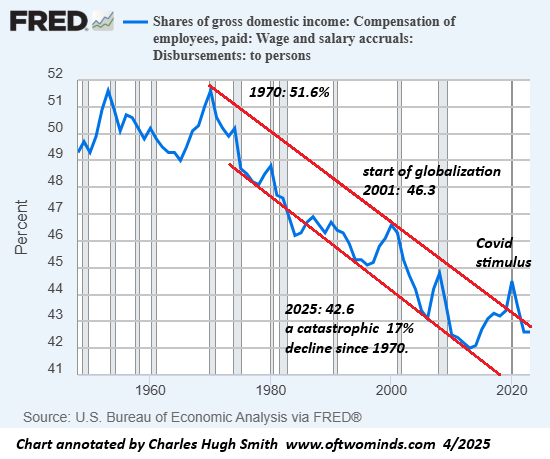

"Great Powers" claim their greatness on prestige technologies and military force, but how do they measure up if we change the metrics to how they treat their workforces. How great are they then? China and the U.S. claim the mantles of "Great Powers" but if we look at how well they treat their workforces, both rate poorly. What matters in assessing the workforce isn't just wages; what matters is the entire quality of life. In this regard, childcare matters, because 1) without children, the "Great Power" has no future, and 2) the lives and budgets of workers with children revolve around the ease or difficulty of caring for their children. The "Great Power" state can either do a lot, do a little, or do nothing to help working parents. Now that China's birthrate is plummeting, the state has launched a few modest initiatives to help parents with the high costs of raising children. If we consider the cost of childcare to per capita GDP, the cost of childcare and education in China is high. It's also absurdly burdensome in the U.S., which has also left childcare expenses up the parents and market forces, which unsurprisingly have pushed the costs of having a child and childcare to the stratosphere. China's total fertility rate was 1.1 children per woman in 2024, far below the replacement level of 2.1 children needed to sustain a stable population. America's rate is around 1.6, also below replacement. Compared to nations that pay for three years of childcare leave so at least one parent can care for the child at home to age 3, the "Great Powers" aren't even close to "great." Abysmal is a better description. Let's consider another metric: how well do the "Great Powers" treat their small-scale farmers and the people who raise their food? Once again, both "Great Powers" rate poorly. While the financial media focuses breathless attention on AI and measures of consumption, few pundits bother looking at how well the "Great Powers" treat their small-scale farmers and ag workforce. Pensions for low-earning family farmers? Not "great" by any measure. After all, who needs children or food when you have AI data centers and robots delivering ultra-processed snacks? In both self-proclaimed "Great Powers," the workforce is viewed as 1) a resource to be exploited (China's infamous "996," the grind of 9 a.m. to 9 p.m., six days a week, and America's equally infamous "on call all weekend if the Boss texts you"), or 2) as consumers driving economic "growth" by purchasing more ultra-processed snacks and commoditized experiences. If life is so great for the "Great Power" workforces, then where did laying flat, let it rot, the garbage time of history and the Five No's come from? The Five No's: no house, no car, no extraneous consumption, no marriage and no children. Laying flat (tang ping): rejection of the hyper-competitive rat race and diminishing returns for punishing workloads, the desire for a simpler, more satisfying and enjoyable life; disillusionment with the fast-receding "China Dream / American Dream," and the realization that the promise that material abundance would make everyone blissfully happy is false, as manic consumerism doesn't generate fulfillment, meaning, purpose or happiness. Let it rot (bai lan) summarizes the realization that the present era is the garbage time of history, and the appropriate response is to "actively embrace a deteriorating situation, rather than trying to turn it around." The entire AI story boils down to reaping billions in profits by replacing the human workforce en masse, another manifestation of exploitation and disregard. The workforce's "job" is to generate and consume declining-quality products and services to generate "growth" and profits, a resource to be exploited that is more or less divided into debt-serfs (bottom 80%) and tax donkeys (top 10%), with the remaining 10% luxuriating in an illusory "middle class" featuring both debt and taxes. In both "Great Powers," the billionaire and political classes are doing great, the workforce, not so much, as market forces have jacked up the cost of living and the gains of their labor are siphoned off and sluiced into state excess and capital gains, 90% of which are collected by the ownership / shareholder class. This chart tells the story of the past 50 years: labor's share of the national income has declined, to the benefit of the top few. The garbage time of history, indeed.

In the labored daze of AI hype and GDP "growth," few seem to notice the workforce is tired of being exploited as an uncomplaining resource. Since outright revolt is quickly crushed by state force, the only option is opting out, via financial nihilism, laying flat, the five No's or let it rot, all expressions of the abandonment of false promises and diminishing returns on following orders. Check out my new book Ultra-Processed Life and my updated Books and Films. Become a $3/month patron of my work via patreon.com Subscribe to my Substack for free My recent books: Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site. Ultra-Processed Life print $16, (Kindle $7.95, Hardcover $20 (129 pages, 2025) audiobook Read the Introduction and first chapter for free (PDF) The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $16, (Kindle $6.95, audiobook, Hardcover $24 (215 pages, 2024) Read the Introduction and first chapter for free (PDF) Self-Reliance in the 21st Century print $15, (Kindle $6.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF) When You Can't Go On: Burnout, Reckoning and Renewal $15 print, $6.95 Kindle ebook; audiobook Read the first section for free (PDF) Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $6.95, print $16, audiobook) Read Chapter One for free (PDF). A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $6.95, print $15, audiobook $17.46) Read the first section for free (PDF). Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World (Kindle $3.95, print $12, audiobook) Read the first section for free (PDF). The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $3.95 Kindle, $12 print); read the first chapters for free (PDF) Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free Become a $3/month patron of my work via patreon.com. Subscribe to my Substack for free Ultra-Processed Life print $16, (Kindle $7.95, audiobook, Hardcover $20 (129 pages, 2025)

Ultra-Processed Life: the substitution of a synthetic, commoditized, very profitable facsimile for what was once authentic. Ultra-Processed Life is my term for everything that is analogous to ultra-processed snacks: attractively marketed, instantly alluring, easy to consume, addictive by design, tasty in the moment but harmful over time, its origins a black box of unknown processes, the brightly colored product bearing no resemblance to the real-world ingredients, an idealized form of what is inherently imperfect, untethered from the natural world or the future, disconnected not just from the consequences of our consuming the snack but disconnected from the consequences unleashed by those consequences. This book recounts my journey of discovery of how our everyday realm has drifted away from the foundations of human life and happiness without our noticing. As with many others, the catalyst for my exploration was a life-threatening medical crisis that did not have a specific cause. This led me to wonder if our entire way of life is like an ultra-processed snack: tasty but not healthy, edible but stripped of the nutrients we need to be healthy, addictive by design. Read the Introduction and first chapter Reader Jeff H. "Having this book during the life stage of middle age and two teens coming of age couldn't be better-timed. Smith makes a compelling case for us to refocus on what truly matters: community, meaningful work, and simply starting a small vegetable garden. Getting out of the rat race can be done locally and incrementally. It just takes a willingness to experiment, connections with others and a large dose of patience. There is a big difference between blame and responsibility. We may not be to blame for our current predicaments in modernity, but the responsibility is ours (responsible = response-able; able to respond). It is our duty to instruct the next generation about the reality of the situation and guide them along a better path." The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $20, (Kindle $9.95, Hardcover $24 (215 pages, 2024) audiobook, Read the Introduction and first chapter for free (PDF)  What if growth--and policies to accelerate growth--are no longer working because our fix for every problem--growth at any cost--is failing? We're told Progress is inevitable as a result of technology, but everyday life is getting harder, not easier--the opposite of Progress, what I call Anti-Progress.

What if growth--and policies to accelerate growth--are no longer working because our fix for every problem--growth at any cost--is failing? We're told Progress is inevitable as a result of technology, but everyday life is getting harder, not easier--the opposite of Progress, what I call Anti-Progress.

What if the real source of the unraveling is far deeper than economics or politics? What if the problem is what we see as the inevitable destiny of humanity--Progress--is actually a modern mythology, disconnected from the real-world consequences of growth for growth's sake? We indignantly reject that Progress is a mythology, but our need for mythology hasn't gone away because we've mastered technology; we've created a modern mythology of technology that is heedless of its own consequences. To truly progress, we need a new mythology aligned to 21st century realities. That's the goal of this book. Read the Introduction and first chapter for free

Recent entries: Labored Daze September 1, 2025 AI: The Good, the Bad and the...Woah August 29, 2025 AI: False Savior of a Hollowed-Out Economy August 27, 2025 Our Mafioso Economy August 25, 2025 How Great Powers Fall Apart August 21, 2025 AI Is a Mirror in Which We See Our Own Reflection August 17, 2025 Boiled Frogs: AI Slop, Phishing, Deep-Fakes and Spam, Spam, Spam August 15, 2025 Two Charts of Extremely Perverse Incentives August 13, 2025 If It Walks Like a Duck: Is The AI Mania a Psych-Ops? August 11, 2025 Now Comes the Hard Part August 9, 2025 What Would Happen If Sydney Sweeney Started Gardening and Baking Bread? August 8, 2025 Resilient, Self-Reliant Life Is Hard August 6, 2025 Two Ways to Fix Generational Wealth Inequality August 4, 2025

Go Ahead and Rage at Boomers, But the Problem Is the Entire Economic Order

August 1, 2025

Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency. All contributors are listed below in acknowledgement of my gratitude.

Mastery requires reading and doing.

Of Two Minds Site Links home musings my books archives books/films policies/disclosures social media/search Aphorisms How to Contribute, Subscribe/Unsubscribe sites/blogs of interest original music/songs Get a Job (book) contributors my definition of success why readers donate/subscribe to Of Two Minds mobile site (Blogspot) mobile site (m.oftwominds.com)

HUGE GIANT BIG FAT DISCLAIMER: Nothing on this site should be construed as investment advice or guidance. It is not intended as investment advice or guidance, nor is it offered as such.... (read more) WHY EMAIL TO THIS SITE IS READ BUT MAY NOT BE ACKNOWLEDGED: Regrettably, I am so sorely pressed for time and energy that I am unable to respond to the vast majority of emails. Please know I read all emails, but I can only devote a very limited number of hours to this blog and all correspondence.... Subscriptions to the Weekly Musings Reports Subscribers enable Of Two Minds to post free content. Without your financial support, the free content would disappear for the simple reason that I cannot keep body and soul together on my meager book sales alone. Your financial support is very much appreciated. Subscribers ($7/mo) and those who have contributed $70 or more annually receive weekly exclusive Musings Reports ($70/year is about $1.35 a week). Each weekly Musings Report offers four features: 1. Exclusive essay on an extraordinarily diverse range of insightful topics 2. Summary of the blog this week 3. Best thing that happened to me this week 4. From Left Field (a curated selection of interesting links) There are four easy ways to subscribe: Substack, Patreon, US Mail and Paypal: How to Contribute, Subscribe/Unsubscribe to Of Two Minds What subscribers are saying about the Musings: "What makes you a channel worth paying for? It's actually pretty simple - you possess a clarity of thought that most of us can only dream of, and a perspective that allows you to focus on the truth with laser-like precision." Jim S. Thank you very much for supporting oftwominds.com with your subscription or contribution.

Extra-Special Bonus Aphorisms:

"There is no security on this earth; there is only opportunity." (Douglas MacArthur) "We are what we repeatedly do." (Aristotle) "Do the thing and you shall have the power." (Ralph Waldo Emerson) "Any intelligent fool can make things bigger, more complex, and more violent. It takes a touch of genius and a lot of courage to move in the opposite direction." (E.F. Schumacher, via Tom R.) "He who will not risk cannot win." (John Paul Jones) "When we drink coffee, ideas march in like the army." (Honore de Balzac) "Progress is not possible without deviation." (Frank Zappa, via Richard Metzger) "Victory favors those who take pains." (amat victoria curam) "The man who has a garden and a library has everything." (Cicero, via Lee Bentley) "A healthy homecooked family meal and a home garden are revolutionary acts." (CHS) "Do you know what amazes me more than anything else? The impotence of force to organize anything." (Napoleon Bonaparte) "The way of the Tao is reversal" Or "Reversal is the movement of Tao." (Lao Tzu) "Chance favours the prepared mind." (Louis Pasteur) "Success consists of going from failure to failure without loss of enthusiasm." (Winston Churchill) "Where there is ruin, there is hope for treasures." (Rumi) "The realm of gratitude is boundless." (CHS, 11/25/15) "History doesn't have a reverse gear." (CHS, 12/22/15) Smith's Law of Conservation of Risk: Every sustained action has more than one consequence. Some consequences will appear positive for a time before revealing their destructive nature. Some consequences will be intended, some will not. Some will be foreseeable, some will not. Some will be controllable, some will not. Those that are unforeseen and uncontrollable will trigger waves of other unforeseen and uncontrollable consequences. (July 8, 2014)(thanks to Lew G. for retitling the idea.) Smith's Neofeudalism Principle #1: If the citizenry cannot replace a kleptocratic authoritarian government and/or limit the power of the financial Aristocracy at the ballot box, the nation is a democracy in name only. The Smith Corollary to Metcalfe's Law (The Network Effect): the value of the network is created not just by the number of connected devices/users but by the value of the information and knowledge shared by users in sub-networks and in the entire network. (CHS, 4/6/16) My Credo of Liberation: I no longer care if the power centers of our society--the distant, fortified castles of our financial feudal system--are changed by my actions, for I am liberated by the act of resistance. I am no longer complicit in perpetuating fraudulent feudalism and the pathology of concentrated power. I no longer covet signifiers of membership in the Upper Caste that serves the plutocracy. I am liberated from self-destructive consumerist-State financialization and the delusion that debt servitude and obedience to sociopathological Elites serve my self-interests. (Thank you, Klaus-Peter L., for reminding me) "We've become a culture of excuses rather than solutions: solutions always require sustained effort and discipline." (CHS 4/9/16) "Fraud as a way of life caters an extravagant banquet of consequences." (CHS 4/14/16) "Creativity = problem solving = value creation." (CHS 6/4/16) "Truth is powerful because it is the core dynamic of solving problems." (CHS 7/21/17) "We live in a system of human emotions that masquerades as a science (economics)." (CHS 1/1/18) "Always remember, your focus determines your reality." (George Lucas) "Diversity is for poor people. Sameness is for the successful." (GFB) "When power dissipates suddenly, it dissipates completely." (CHS 7/14/19) "Disobedience is the true foundation of liberty. The obedient must be slaves." (Henry David Thoreau) "Markets cannot price in the value of non-monetized natural assets such as diverse ecosystems." (CHS 7/14/19) "Magical thinking isn't optimism, it is folly." CHS 1/3/22) "Tune in (to self-reliance), drop out (of hyper-consumerism and debt-serfdom) and turn on (to relocalizing capital and agency)." (CHS 1/5/22) "The path to everything you desire starts here: like yourself as you are right now." (CHS 11/20/22) "There are only two signals: how many essentials you produce and share and if you're consuming less with better results. Everything else is noise." (CHS 12/17/22) "Liberation is no longer needing any confirmation or feedback from others or the world for one's sense of self. Wealth, fame, recognition, admiration, praise, prestige, approval, sainthood, martyrdom, success: none are needed, none are desired." (CHS 12/26/22) "When fame, wealth, prestige, status and glory are out of reach, you're free to pursue other more valuable things." (CHS 2/6/22) "It is the sacred duty of every activist who seeks to better their community to grow and share as much life-giving food as is humanly possible." (CHS 6/15/23) "Being anonymous, gray and unknown is the ideal state of freedom." (CHS 3/15/24) "We seem to have entered a world of anti-leisure and anti-productivity in which the unpaid shadow work demanded to keep all the complicated digital bits in motion obliterate our leisure and productivity." CHS (5/22/24) "It is axiomatic that failing systems work the best just before they fail catastrophically." Ray W. "Looking younger is mere technique; thinking younger demands creativity." CHS (10/16/24) "Tell me what's taboo and I'll tell you the truths that threaten the status quo." CHS (12/15/24) "This is the core of the Attention Economy: the ultimate addiction is the addiction to ourselves." CHS (1/28/25) "If You Seek the Truth, Look for What's Taboo." CHS (7/18/25) "My definition of self-reliance: the less you need, the easier it is to get what you need." CHS (7/26/25) "Mastery requires reading and doing." CHS (7/28/25) "The replacement of authentic value, quality, agency, choice, trust, legitimacy and experience with self-serving facsimiles is the key dynamic of Ultra-Processed Life, my term for the present-day human condition." CHS (8/12/25) "Ultra-Processed Life replaces an authentic experience with a synthetic, simulated, commoditized, highly profitable version that's superficially attractive but destructive over the long term." CHS (8/12/25) "What we see everywhere is the replacement of authentic things--including democracy--with synthetic facsimiles designed to maintain the illusion of choice and value." CHS (8/12/25) |

|

||||||||||

|

All content, HTML coding, format design, design elements, original images, videos and musical compositions

and recordings on www.oftwominds.com are protected by copyright © 2025 Charles Hugh Smith, All global rights reserved in all media, unless otherwise credited or noted.

Terms of Service:

All content on this blog is provided by Trewe LLC for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. These terms and conditions of use are subject to change at anytime and without notice.

Our Use of Generative AI Tools Policy:

Our Privacy Policy:

PRIVACY NOTICE FOR EEA INDIVIDUALS

Notice of Compliance with

The California Consumer Protection Act

Regarding Cookies:

Our Commission Policy:

|

|

|

|||||

| home email me (no promise of response, sorry, here's why) mirror site | |||||