Warning Light Flashing Red

April 27, 2021

When the warning light is flashing red, it's prudent to have a capital preservation strategy in place.

Not everyone has an IRA or 401K invested in the stock market, for those who do,

the red warning light is flashing red: markets have reached historic extremes on numerous fronts.

Just like in 2000, proponents claim "this time it's different." Back then, the claim was that

since the Internet would be growing for decades, dot-com stocks could go to the moon and beyond.

The claim the the Internet would continue growing was sound, but the prediction that this growth

would drive stock valuations into a never-ending bubble was unsound.

Once again we hear reasonable-sounding claims being used to support predictions of a never-ending

rise in stock valuations.

What hasn't changed is humans are still running Wetware 1.0 which has default settings for

extremes of emotion, particularly manic euphoria, running with the herd (a.k.a. FOMO,

fear of missing out) and panic / fear.

Despite all the assurances to the contrary, all bubbles pop because they are based in human

emotions. We attempt to rationalize them by invoking the real world, but

the reality is speculative manias are manifestations of human emotions and the feedback of

running in a herd of social animals.

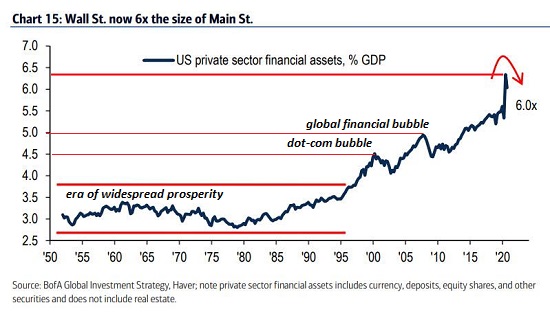

Here's a chart of financial assets as a percentage of Gross Domestic Product (GDP). (below)

Note that in the "Glorious Thirty" years of the postwar era of broad-based prosperity,

financial assets were around 3 times GDP.

This ratio increased with every one of the three bubbles since the mid-1990s: the dot-com bubble

in 1999-2000 (Fed Bubble #1) , the subprime bubble in 2007-08 (Fed Bubble #2)

and now the Everything Bubble of 2020-21 (Fed Bubble #3). Financial

assets are now 6 times the size of the "real economy" (GDP), an extreme beyond all previous extremes.

This reflects the dominance of financial assets based on extreme expansions of debt, leverage and

speculation.

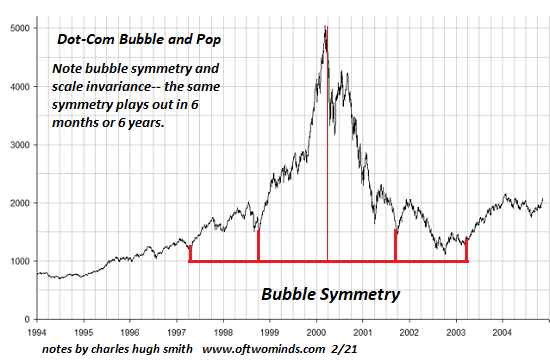

The red warning light of extremes in sentiment, valuation, etc. can flash for quite some time,

but as I've noted over the years, speculative bubbles often display symmetry: those that

spike higher tend to collapse in a mirror-image of the manic rise. This symmetry isn't perfect,

of course, just as correlations are rarely if ever perfect, but as a generality, bubbles tend

to display symmetry as manic greed slips into doubt and then cascades into panic. (see chart below)

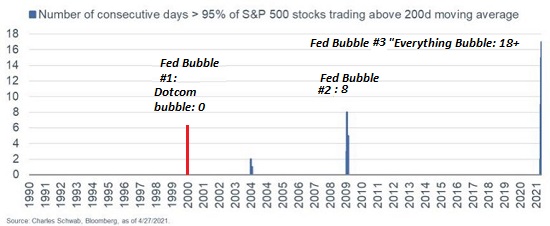

Extreme bullishness is noteworthy. (see chart below of S&P 500 stocks above their 200-day

moving average--a standard definition of a stock in a bullish trend.) Not only is the number of

S&P 500 stocks that aren't in a bullish uptrend essentially signal noise, this extreme reading has been

pegged to the upper boundary for weeks, far longer than the extremes reached in previous manias.

As my old quant boss Stew Pillette would observe, when all the good news is out and

has already been priced into the market, the next bit of news is likely to be bad and not priced in.

There are seven factors to keep in mind that may intensify reversals and risks:

One factor to keep in mind is the dominance of ETFs (exchange-traded funds) and index funds.

As money pours into these passive funds, the funds buy whatever stocks are in the ETF or index.

Good, bad and indifferent stocks in each ETF or index are purchased without any assessment of

their relative value.

When owners sell, the process is reversed: every stock in the ETF or index is automatically sold

to fund the redemption. This leads to "the baby being thrown out with the bathwater" as the best

performing companies get sold off with the dregs in the ETF or index.

Another factor to keep in mind is the reliance of bubbles on borrowed money (margin debt)

and leverage: 2X and 3X leveraged ETFs and a variety of financialization tricks to increase

leverage and thus gains. When assets that have been leveraged reverse even modestly, the losses

are quickly consequential, and the "solution" is to liquidate every leveraged asset before the

position is wiped out. Selling begets selling, and this is the self-reinforcing feedback of crashes.

A third factor to keep in mind is the decline of short interest to all-time lows. Put another

way, the number of speculators who have an incentive to buy shares in a decline is near all-time

lows, so the only buyers in a real decline will be "buy the dip" players who will soon be wiped

out if the decline continues.

A fourth factor to keep in mind is the narrowing of the speculative universe into a few assets.

This creates an extreme dependency on the few rocketships to keep soaring lest the entire ETF / index

fund world collapse.

A fifth factor to keep in mind is the potential for the Covid virus to spread globally beyond current

expectations. Such an expansion could trigger a global slowdown / recession.

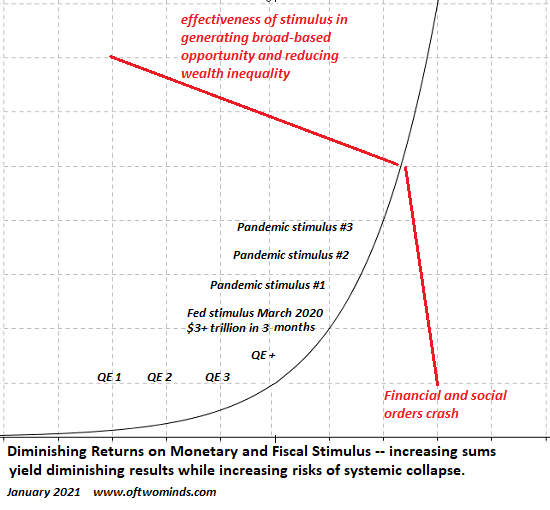

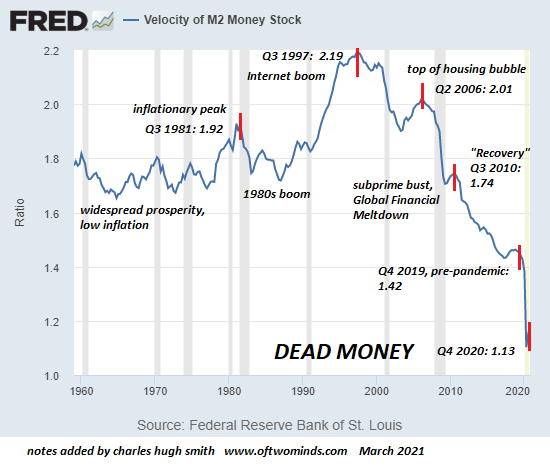

A sixth point to keep in mind is that all fiscal and monetary stimulus suffers from diminishing

returns. (see chart below) The chart of money velocity suggests the returns have fallen off a cliff.

(see chart below)

A seventh factor is the dominance of algorithm-driven trading (algos, trading bots, etc.,

which appears to be mostly programmed to be momentum / trend-following. If these programs are withdrawn

to avoid high volatility, the liquidity the market depends on to maintain stability may dry up,

increasing the odds of the market going bidless, i.e. buyers vanish and prices crash.

When the warning light is flashing red, it's prudent to have a capital preservation strategy in place.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My new book is available!

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

20% and 15% discounts (Kindle $7, print $17,

audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

AxisOfEasy Salon 42: Is System Change Likely, Possible or Inevitable? (58 min)

Charles Hugh Smith on the Terminally Ill Economy (49 min)

Keiser Report | Bilking Grandma is the Business Model

In the second half, Max interviews Charles Hugh Smith of OfTwoMinds.com about the 'fatal synergies'

and the 'sealed pressure cooker' resulting when the system refuses to offer a solution to those

denied a voice or access to resources. They also discuss the oversupply of elites and the chaos

this ultimately brings to society.

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 (Kindle), $10 (print), (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 (Kindle), $8.95 (print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Cynthia F. ($50), for your marvelously generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, John S. ($50), for your magnificently generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

|