(December 4, 2012)

Efforts to collect more taxes fail because people adjust their behavior accordingly.

Amidst all the "fiscal cliff" talk of raising tax rates, few dare to ask:

have tax revenues topped out?

How could tax revenues decline as rates go up? Easy: people modify their

behavior in response to whatever incentives and disincentives are present.

Make mortgage interest deductible and people will rack up huge mortgages.

Reduce the yield on savings to near-zero (thank you, Federal Reserve) and

people will save less.

Raise tax rates and people will lower their income or move to low-tax locales.

As the saying has it, "Money goes where it is treated well."

Supporters of higher rates tout studies that find upper-income taxpayers

shrug off higher rates, staying put in high-tax states:

Do High Taxes Chase Out The Rich? and

Superrich stay put in high-tax states like California.

On the other side of the

ledger is this study from Britain:

Two-thirds of millionaires left Britain to avoid 50% tax rate.

Which view is correct? Both, as a result of different dynamics. There are at least

four separate dynamics in play.

1. The professional class is often "captured" and cannot move. For tax purposes,

households with incomes of $500,000 and up are considered wealthy, i.e. above middle

class incomes. Many of these people are self-employed or professional such as doctors

and attorneys.

In theory, they could move to lower-tax states or nations, but their practice or

enterprise is often local--pulling up stakes would mean sacrificing their high income

which is the result of years or decades of networking and building local social capital.

Many of these high-earners are also trapped by their demographics: their kids are

relying on their high incomes to pay their college costs, and aging parents may rely

on their proximity and income.

Moving away is simply not an option for these high earners. So it's not that

these professionals approve of higher taxes, they just don't have any practical alternative.

2. What self-employed high earners can do is lower their earnings. If the

threshold is $250,000 each, then they will lower their taxable income to $245,000.

Those with S corporations, limited liability corporations, etc. have legal ways

to lower their taxable income while retaining the benefits of their entity's income.

For example, maybe the corporation will buy a live/work loft as an office, eliminating

the owner's personal mortgage. The corporation effectively pays the mortgage,

meaning their earned income can drop significantly.

Others will choose to work less. Why work so hard just to pay more taxes? Refuse

work, cut your hours, enjoy life more.

3. The super-wealthy have the means to transfer income and wealth to lower-tax nations and

pursue legal loopholes in the U.S. tax code. Those households making a mere $500,000

rarely have the financial wealth or firepower to justify the costs of hiring

big-bucks tax attorneys and moving their assets and operations overseas.

This is the primary difference between high earners and the truly wealthy: the

merely well-paid have fewer incentives to establish a legal enterprise overseas and

deal with the complexities of the U.S. tax code, which considers all income from

all sources to be taxable U.S. income.

For example, a wealthy U.S. citizen may earn $10 million a year, but by buying a

villa and establishing a corporation in a low-tax nation, they can legally lower their

tax rate on income earned or declared in the low-tax nation. By expensing all sorts

of things against their U.S. income, they can effectively pay the U.S. rate on

a small portion of their earnings while sheltering 90% overseas in perfectly legitimate

ways.

Shifting assets and income streams to shelter income is de rigeur. The wealthy have

more opportunities to do so, and so it is unsurprising that they would take those

opportunities.

The wealthy and corporations are used to juggling tax code complexities and

international assets/declared income; they have to do this to maximize shareholder value.

Jacking up rates basically impacts the "captured" professionals and small business

owners who have large earned incomes.

At some point many of these people will decide to sell out, retire, or drastically trim their

enterprise to avoid working hard just to pay more taxes.

4. These basic avoidance strategies--earning less money and moving income and assets

to lower-tax nations--are already common and relatively easy for those with control

of their incomes and assets. Tax avoidance is universal, which is why tax

increases always raise less money than linear projections anticipate.

If the sales tax or VAT goes up, people buy less retail and buy more on the cash-black market.

The wealthy are simply doing the same thing on a larger scale.

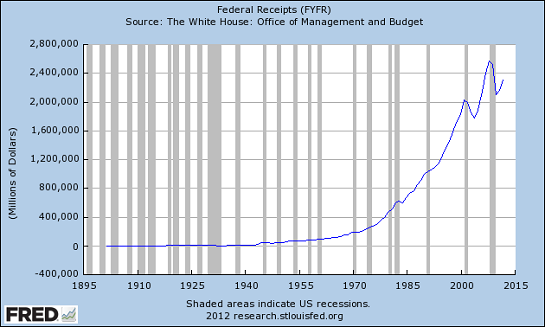

Those with an interest in technical analysis may discern a topping pattern in this

chart of tax receipts. It looks like the resurgent tax receipts of the QE/stimulus

era will top out and roll over as the global recession deepens in 2013,

forming a lower high.

We can anticipate a stairstep down pattern as tax receipts decline, new tax increases

bump up revenues for a brief time and then people respond with more tax avoidance and

tax revenues will resume their decline.

Various studies have found that Federal tax revenues top out just above 20% of total

household income, regardless of the era or nominal tax rates. Recall that in many high-tax

economies, up to 50% of the economic activity occurs in the informal/black market.

When tax rates are high, people move their consumption and enterprise into the cash

informal economy and only pay taxes on half their total income. This is one way that

people limit the amount of taxes they pay to around 20%, regardless of the nominal

tax rate.

Efforts to collect more taxes fail because people adjust their behavior accordingly.

Linear projections of rising tax revenues always fail to account for this easily

predictable behavioral response.

I have addressed these issues many times:

Will "Tax the Rich" Solve Our Deficit/Spending Crisis? (December 28, 2011)

The Future of America Is Japan: Runaway Deficits, Runaway Debts (October 15, 2012)

About Raising Taxes as the "Solution" to the Fiscal Cliff.... (October 26, 2012)

The Fiscal Cliff and the Grand Bargain (November 28, 2012)

NOTE: I will be taking a few days off from online work, so I will be unable to

respond to email. Thank you for your understanding.

SPECIAL OFFER ON GREEN COFFEE BEANS FOR LONG-TERM STORAGE FROM EVERLASTING SEEDS:

Here is a note from ES's founder: "I've successfully stabilized green coffee beans for a period of six years and still

had them roast up to within 90-95% of their 'new' bouquet, smoothness, and flavour

characteristics. We've finally got all of the odds and ends together, along with the best

'stove top' roaster {Whirley Pop} that we're found. The coffee beans are all 100% Organic:

Peruvian, Colombian, and Guatamalean in two sizes, 1 lb. And 5 lbs. the sealed cans

contain a small 'Roasting Guide' that gives basic instructions, roasting times and temps,

etc. This is, by necessity, only a brief intro with the essential information, as it

has to fit into our smaller, 'chowder' size can.

It's taken me nearly ten years to experiment, wait, and finally find a method that would

preserve the bean's natural flavours and oils. The other thing that suggested itself to

me is that I can think of few things, outside of the obvious 'necessities'

{Bible, beans, bullets} that would be more valuable, command a higher price, and be

virtually instantly 'tradeable' anywhere, anytime after an 'event': coffee is, in

a multitude of ways, our latter day 'comfort food.'"

My new book Why Things Are Falling Apart and What We Can Do About It is now available in print and Kindle editions--10% to 20% discounts.

Things are falling apart--that is obvious. But why are they falling

apart? The reasons are complex and global. Our economy and society have structural

problems that cannot be solved by adding debt to debt. We are becoming poorer, not

just from financial over-reach, but from fundamental forces that are not easy to identify

or understand. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization

2. Crony capitalism and the elimination of accountability

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their

own weight and are replaced by systems that are simpler, faster and affordable. If

we cling to the old ways, our system will disintegrate. If we want sustainable prosperity

rather than collapse, we must embrace a new model that

is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Not accepting responsibility and being powerless are two sides of

the same coin: once we accept responsibility, we become powerful.

10% discount on the Kindle edition: $8.95 (retail $9.95)

print edition: $24 on Amazon.com

To receive a 20% discount

on the print edition: $19.20 (retail $24), follow the link, open a Createspace account and enter

discount code SJRGPLAB. (This is the only way I can offer a discount.)

Please click on a book cover to read sample chapters

Please click on a book cover to read sample chapters

NOTE: gifts/contributions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Hugh W. ($5/month), for your most-excellently generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Steven C. ($120), for your outrageously generous contribution

to this site --

I am greatly honored by your steadfast support and readership.

|

"This guy is THE leading visionary on reality.

He routinely discusses things which no one else has talked about, yet,

turn out to be quite relevant months later."

--Walt Howard, commenting about CHS on another blog.

Or send him coins, stamps or quatloos via mail--please

request P.O. Box address.

Subscribers ($5/mo) and contributors of $50 or more

this year will receive a

weekly email of exclusive (though not necessarily coherent) musings and amusings.

At readers' request, there is also a $10/month option.

What subscribers are saying about the Musings

(Musings samples here):

The "unsubscribe" link is for when you find the usual drivel here

insufferable.

Your readership is greatly appreciated with or without a donation.

All content, HTML coding, format design, design elements and images copyright ©

2012 Charles Hugh Smith, All rights

reserved in all media, unless otherwise credited or noted.

I am honored if you link to this essay, or print a copy for your own use.

Terms of Service:

All content on this blog is provided by Trewe LLC for informational purposes only. The owner of this

blog makes no representations as to the accuracy or completeness of any information

on this site or found by following any link on this site. The owner will not be liable

for any errors or omissions in this information nor for the availability of this information.

The owner will not be liable for any losses, injuries, or damages from the display or

use of this information. These terms and conditions of use are subject to change at

anytime and without notice.