Is This "The Top"?

January 6, 2020

Parabolic moves end when the confidence that the parabolic move can't end becomes the consensus.

The consensus seems to be that the stock market is on its way to much higher levels, and soon. The near-term targets for the S&P 500 (SPX, currently around 3,235) range from 3,500 to 4,000, with longer-term targets reaching "the sky's the limit."

The consensus reasoning goes like this:

-- Central banks can print a lot more money

-- Stocks rise when central banks print more money.

The history of the 2009-2019 era strongly supports this simple cause-effect, and so just about everyone is on the same side of the boat, the "don't fight the Fed" side of ever-higher stock multiples and ever-higher prices.

Simply put: sales and profits no longer matter, the only thing that matters is whether central banks are printing more money. And since we all know they'll have to print more money to keep the flying pig (the stock market) aloft, then it follows as night follows day that stocks will rise essentially forever.

As soon as the consensus has settled complacently on one side of the boat, contrarians take notice as history has a perverse habit of foiling any overwhelmingly complacent consensus.

The contrarian asks: what if this is "The Top"? Not just the top of the current rally, but The Top of the Bull Market that ignited in March 2009? Impossible, say the Bulls; there's cash on the sidelines, Uber/Lyft drivers aren't yet touting obscure stocks, i.e. "everybody" is not yet in the market, central banks haven't even warmed up their digital printing presses, corporations are flush with cash/credit to continue their decade-long gorging on stock buy-backs and the global economy is back on track for another decade or three of tepid "growth."

Maybe this is all true, maybe not. Maybe Uber/Lyft drivers are too broke to care about the stock market. Maybe "cash on the sidelines" isn't interested in gambling in the equity-bubble casino. Maybe corporate credit dries up. Maybe stock buy-backs are no longer sufficient to push stocks higher by 30% to 100% every year. Maybe there are limits on the effectiveness of central bank stimulus. Maybe the false dawn of global growth is fading.

Maybe diminishing returns (including but not limited to diminishing marginal returns) are setting in and all these bullish dynamics are running on fumes.

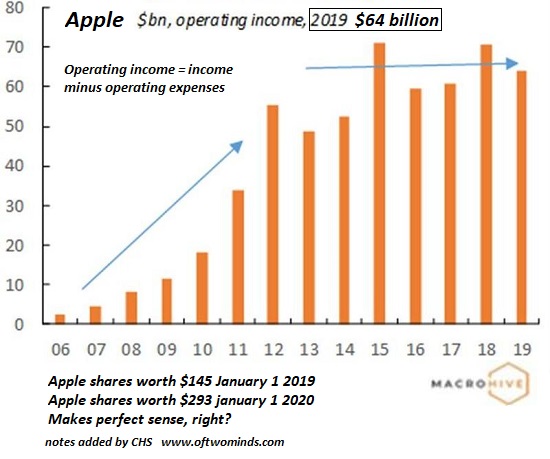

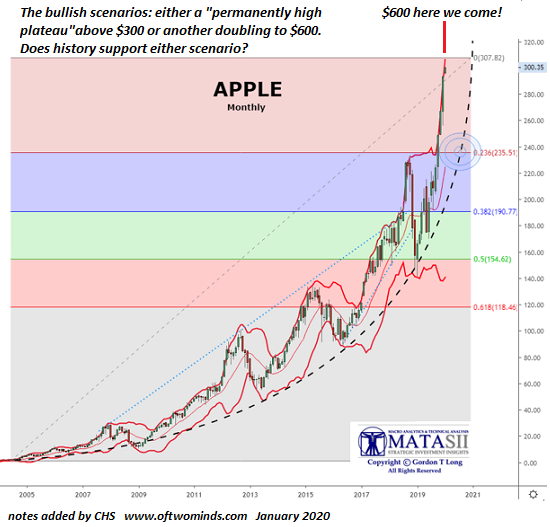

As a case study, let's look at two charts of Apple: operating income and its stock price. Interestingly, operating income has been stagnant to down for years, while the stock price has gone parabolic.

History has recorded many parabolic moves like this, and they all end badly.

Yet the consensus faithful continue to believe that there are only two scenarios to choose from:

1. Apple stock has reached a "permanently high plateau" around $300

2. Apple stock will continue doubling: $75 to $150, $150 to $300, $300 to $600.

All previous parabolic moves reversed in roughly symmetric fashion, returning to their starting base (or lower). So the consensus is claiming that, ahem, this time it's different. Maybe, maybe not.

These parabolic ascents are characterized by 1) increasing amplitude and 2) time compression: each ascent leaps higher and in less time than previous moves. Why? The consensus is so strong that everyone starts front-running the next ascent. This front-running accelerates as everyone tries to front-run the front-runners.

Parabolic moves end when the confidence that the parabolic move can't end becomes the consensus. Nobody believes this could be The Top because the confidence that every future ascent can be front-run is so high.

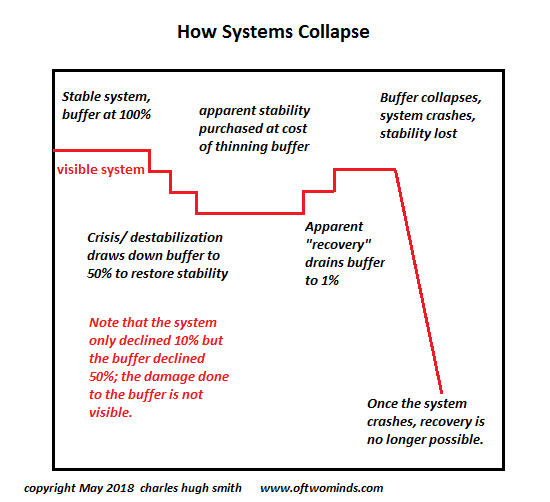

Another way to understand this dynamic is that beneath the surface stability, buffers have eroded and are now paper-thin. I covered how this works in How Systems Collapse (May 29, 2018):

As I explain in my recent book Will You Be Richer or Poorer? Profit, Power and A.I. in a Traumatized World, we don't look at systemic buffers, much less measure them, and so the precariousness of parabolic moves is invisible to the consensus.

Every central bank "save" and every tsunami of stimulus has eroded systemic buffers. Now that everyone is counting on the current tidal wave of stimulus to lift all boats, the buffers will give way in a disorderly systemic destabilization.

If you want to wait for the Uber/Lyft driver to share a hot stock tip to signal the top, be my guest. But you might want to look at WeWork's collapse as an alternative signal that The Top Is In. While financial pundits are cheering the next ascent to SPX 4,000, nobody seems to have noticed that most of America is over-indebted and broke.

But never mind that; Apple $600 and SPX 6,000 guaranteed, hum baby!

My recent books:

Will You Be Richer or Poorer? Profit, Power and A.I. in a Traumatized World (Kindle $6.95, print $11.95) Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic ($6.95 (Kindle), $12 (print), $13.08 ( audiobook): Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake $1.29 (Kindle), $8.95 (print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Christopher G. ($5/month), for your superbly generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, Duane S. ($25), for yet another splendidly generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

|