Is Inflation "Transitory"? Here's Your Simple Test

June 16, 2021

Is inflation "transitory" in your household budget? Really? Where?

The Federal Reserve has been bleating that inflation is "transitory"--but what about the

real world that we live in, as opposed to the abstract funhouse of rigged statistics?

Here's a simple test to help you decide if inflation is "transitory" in the real world.

Let's start with some simple stipulations: price is price, there are no tricks like hedonics

or substitution. Nobody cares if the truck stereo is better than it was 40 years ago, the

price of the truck is the price we pay today, and that's all that matters.

(Funny, the

funhouse statistical adjustments never consider that appliances that used to last 30 years now

break down and are junked after 3 years--if we adjusted for that, the $500 washer would be tagged

at $5,000 today because it has lost 90% of its durability over the past 30 years.)

Second, inflation must be weighted to "big ticket" nondiscretionary items. The funhouse statistical trickery

counts a $10 drop in the price of a TV (which you buy every few years at best) as equal to a $100

rise in childcare, which you pay monthly. No, no, no: a 10% rise in rent, healthcare insurance and

childcare is $400 a month or roughly $5,000 a year. A 10% decline in a TV you buy every three years

is $50. Even a 50% drop in the price of a TV ($250) is $83 per year--absolutely trivial,

absolutely meaningless compared to $5,000 in higher big-ticket expenses.

You can forego the new TV but not the rent, childcare or healthcare. That's the difference between

"big ticket" nondiscretionary and discretionary (meals out, 3rd TV, etc.).

Third, we jettison the painfully obvious manipulation of "owners equivalent rent" for housing

costs. Housing costs are the prices we pay for rent, owning a home and paying property taxes,

insurance and maintenance costs to own the home. (Have you priced having a new roof put on your

house by a licensed, reputable contractor? No? Well, it's become a lot more expensive than it was

a few years ago. Where is that enormous price leap in "owners equivalent rent"? Just how stupid

does the Fed reckon we are?)

OK, here's the test: let's say markets finally take a deflationary dive from overvalued

heights. Housing, stocks and other risk assets fall 30%. Trillions of dollars in "wealth"

(that didn't exist prior to the Everything Bubble inflating) has vanished, generating

a reverse wealth effect as all the owners of these assets feel poorer and less inclined to

borrow and spend. This is classically considered highly deflationary: demand drops, prices drop.

The three billionaires who own more assets than the bottom 50% of Americans (165 million Americans)

will be crying, but how does life change for the 165 million Americans who own a vanishingly thin

slice of these assets? Does their rent drop? No, for the reasons I explained in

The Fed Is Wrong: Inflation Is Sticky: the big corporate landlords have to keep rents high to

placate their lenders. (And let's not forget greed: the greedy never want to lower prices,

preferring to cling to the Fed's fantasy of "transitory" trouble.)

Now let's ask about the higher-income 150 million Americans who own homes and pay property

taxes, who pay healthcare insurance, college tuition and fees, childcare and elderly care.

Even if there is a deflationary crash in stocks and housing, what are the odds the overall costs

of owning and maintaining your home will drop significantly?

What are the odds that local government will let property taxes drop with valuations? Shall

we be honest and say zero? If real estate valuations plummet, then property tax

rates will rise to compensate. Or other "creative" fees will be imposed to make up the shortfall

in tax revenues.

What about childcare? What are the odds that childcare costs will drop 30%?

Shall we be honest and say zero? The costs paid by childcare providers only go up,

and so those who don't charge enough (marginal providers) will close down, generating a

shortage of supply that elevates prices.

What about elderly care? Will assisted living facilities suddenly drop 30% just because

asset bubbles pop? No. The costs of assisted living march higher regardless of what asset

valuations and interest rates do.

What about healthcare? Will all those costs drop 30% because assets declined? No.

Everyone exposed to real-world pricing of healthcare will be paying more.

But what about the roofing contractor? Won't they charge 30% less? The biggest expenses

for the contractor are workers compensation insurance, liability insurance, disability insurance,

FICA (Social Security and Medicare) and healthcare insurance, and none of those will drop a

single dollar even if stocks drop 30%.

Just as 85% of local government expenses are labor-related, most of the expenses of the roofing

contractor are labor-related. The roofing materials dropping a few bucks might lower the cost

by a few percentage points, but the material costs are based on the costs of the manufacturers,

distributors, truckers, etc., and these are also based on labor-related expenses, taxes, insurance

and healthcare--none of which will drop a dime, regardless of what asset prices do.

Economist Michael Spence elucidated the difference between tradable and untradable goods

and services. If you want your washer repaired, that service in untradable, as shipping

your broken washer to China for repair is not financially viable. As labor costs rise in China

and other offshore economies, that raises costs even for tradable goods.

The majority of essential services are untradable and the costs are dependent on "big ticket"

expenses which cannot go down without imploding the economy and government: taxes, insurance,

healthcare, childcare, elderly care, etc. cannot drop 30% because they're based on labor costs,

highly profitable systemic friction (Big Pharma, the Higher Education Cartel, Big Ag, healthcare

and other quasi-monopolies) and the need for ever-higher tax revenues to provide services which

the public demands.

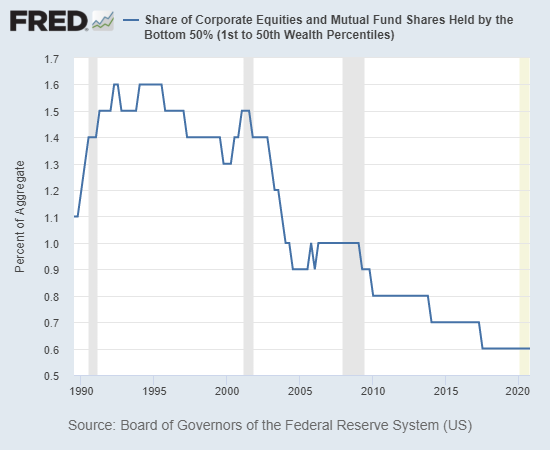

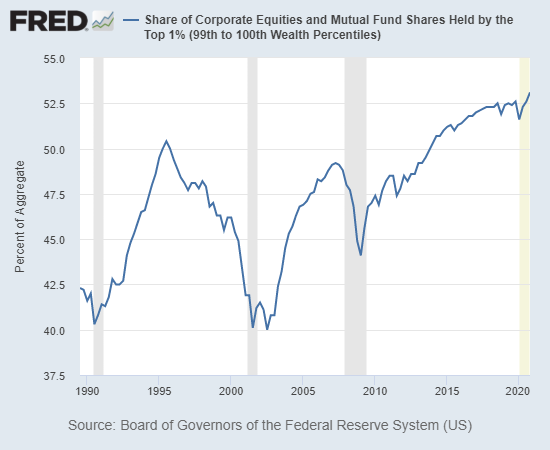

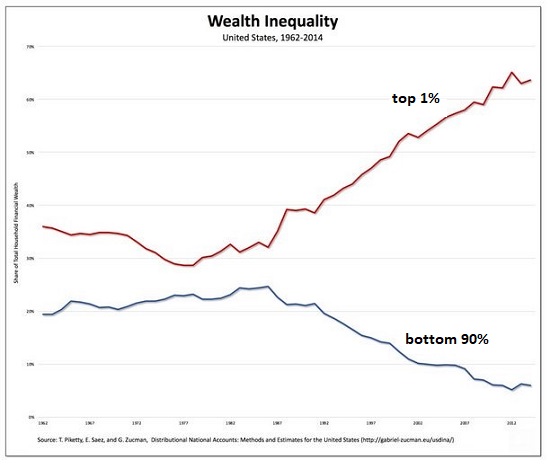

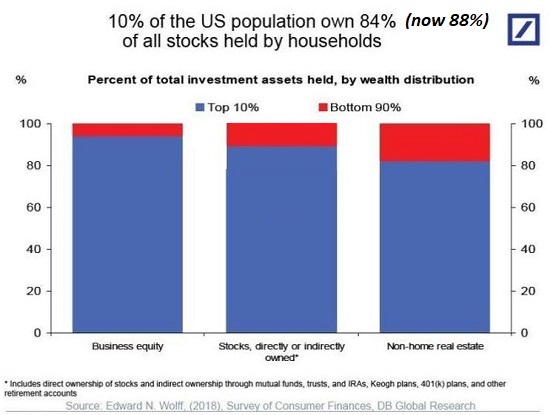

Let's also ponder the consequences of the extreme concentration of wealth and income in the top

5% of U.S. households. The top 10% own roughly 85% of all wealth, and the top 1% own more

than half the financial wealth.

Any significant drop in financial assets will have almost no effect on the bottom 90% because

they don't own enough of these assets to be consequential. So the deflationary effect of

the reverse wealth effect will be concentrated in the discretionary spending of the

top 10%: the luxury imported vehicles, the $100 per plate dinners (those $60 bottles of wine

add up), the $500/day resort vacation, the $2,500/week AirBnB rental, etc.

The declines in the cost of these discretionary luxuries may well be noteworthy, but there

are thresholds below which prices cannot drop. The high-end restaurant has equally high-end

expenses, and so marginal providers will close, leaving only those few who can maintain profitability

as demand for luxury dining craters.

The resort has high expenses as well, and once profitability has been lost, resorts will close

just like other marginal providers. Supply shrinks along with demand, and the survivors

keep prices high enough or they too will close.

So the essential "big ticket" costs will keep rising and the discretionary luxuries only

the top 10% can afford will drop--but not by much as all those luxury providers have

the same high fixed costs.

So to recap the test: what are the odds of these "big ticket" expenses dropping 30% if asset

prices drop 30%?

Taxes: zero.

Healthcare: zero.

Childcare: zero.

Elderly care: zero.

Costs of doing business: zero.

As for housing: the mortgage doesn't drop if the market value of the house drops 30%, and any

declines in insurance will be modest. The costs of maintenance won't drop much, either, and

might actually increase as the supply of skilled workers declines. (Nothing is more expensive

than the "cheap" repair that has to be redone correctly.)

Rents may drop in areas nobody wants to live anymore, but rents will rise in places people

do want to live.

The larger point here is the long economic cycles have turned. The 40-year decline in

interest rates has turned, whether we admit it or not. The 40-year decline in the prices of goods due to

financialization (lower interest rates, higher speculative assets) and globalization has turned.

The 40-year expansion of the workforce has turned. The 40-year decline of

oil/fuel/resources prices has turned. The 40-year fantasy that we can depend on other nations for

our essential resources and components is drawing to a close.

Untradable goods and services, cost thresholds, resource security, the end of financialization /

globalization and declining interest rates matter. The fantasy that the top 10% can prop up

the economy by borrowing and spending the phantom wealth of insanely overvalued asset

bubbles is drawing to a close.

Is inflation "transitory" in your household budget? Really? Where?

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My new book is available!

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

20% and 15% discounts (Kindle $7, print $17,

audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Podcasts:

Charles Hugh Smith on the Era of Accelerating Expropriations (38 min) (FRA Roundtable Insight)

Covid Has Triggered The Next Great Financial Crisis (34:46)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 (Kindle), $10 (print), (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 (Kindle), $8.95 (print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Paul B. ($5/month), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, John B. ($54), for yet another marvelously generous contribution to this site -- I am greatly honored by your support and readership. |

|