Would Returning to the Gold Standard Resolve Our Most Pressing Monetary Problems?

May 24, 2024

We all know the problem with fiat currency: the temptation to print more currency is irresistible, but ultimately destructive.

Money in all its forms attracts quasi-religious beliefs and convictions. This makes it difficult to discuss with anything resembling objectivity. But given the centrality of money (and its sibling, greed) in human affairs, let's press on and ask: would returning to the Gold Standard (i.e. gold as money / gold-backed currency) resolve our most pressing monetary problems?

The conviction that the answer is "yes" is widespread. In this view, President Nixon "closing the gold window," in 1971, i.e. ending the convertibility of the US dollar to gold in international foreign exchange (FX) markets, is the Original Sin that doomed us to the inflationary Hell of fiat currency, i.e. currency unbacked by anything tangible such as gold or silver.

In this view, the only way to avoid the consequences of this Original Sin--the eventual reduction of fiat currency to zero value via hyper-inflation as the currency is "printed" without restraint--is to return to the gold standard.

So far, so good, but from here on in it gets tricky. We have a long history of precious metals being the only form of money in various economies, and an almost as long history of paper money augmenting precious-metal "real money" (in China, for example) and the issuance of copper coinage to grease small transactions.

Gold-backed currency rolls off the tongue rather easily, but what exactly does this mean? In theory, it means every unit of paper / digital currency in circulation can be converted on demand to a physical quantity of gold or silver at an exchange rate either set by the nation-state's government or by the market.

This conversion acts as a governor on the issuance of new currency: if the nation has $100 billion in gold/silver, it cannot issue $1 trillion in currency, as the whole idea of conversion is that each unit of currency can be fully converted to gold/silver. So in a truly gold-backed currency, the money supply in circulation must be limited to $100 billion.

There are various tricks that can be played here, of course. The government can assign a conversion rate that doesn't align with the actual market value of gold/silver, for example. Or it can limit conversion to the settlement of foreign trade with other nations.

Let's return to Nixon's Original Sin and stipulate that there is no such thing as "free trade", as all trade has geopolitical and domestic-economic elements. Those nations whose domestic growth depends on increasing exports, i.e. mercantilist economies, will naturally trumpet "free trade" as a cover for their exploitation of trade for domestic growth while they restrict imports.

Many observers seem to forget the US was engaged in an existential geopolitical struggle with the USSR in the 1950s, 1960s and beyond. Gaining and maintaining allies and "spheres of influence" were core dynamics in this global contest, and the US had over-riding reasons to support the war-devastated economies of its allies in Europe and Asia by enabling them to export goods to the US.

The US also had over-riding reasons to maintain the US dollar (USD) as a reserve currency, a currency that is available in sufficient quantity globally to grease commerce and credit and also act as a stable foreign exchange reserve for both private enterprises and nations.

Issuing a reserve currency offers an exorbitant privilege--what we might call monetary hegemony--but it comes with a price, a price explained by economist Robert Triffin as Triffin's Paradox, which has two key paradoxical dynamics:

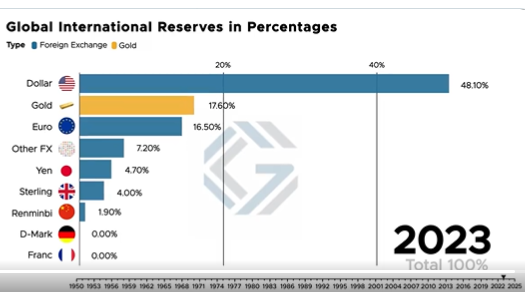

1. The issuing nation must run a sustained trade deficit in order to "export" sufficient quantities of its currency into the global marketplace to meet the expansive needs of global trade and other nations. (This helps explain why the USD is roughly half of all reserves (48%) while China's RMB is only 2% of reserves: exporting nations running surpluses don't "export" their currencies for use by others.)

2. This need to serve international trade / geopolitical goals is fundamentally in conflict with the goals of the domestic economy: the currency cannot serve two masters equally well.

Why did Nixon end USD conversion to gold? He had no choice, as the geopolitically necessary trade deficits were rising to the point that America's gold holdings would have diminished to zero were the rising trade deficits settled in gold.

Existential challenges take precedence. To say that the US should have given up its reserve currency and insisted our struggling allies maintain balanced trade with the US is to ignore the geopolitical realities.

We must also recognize that markets discover the price/value of competing currencies, and so nations whose currency is priced higher than others will have difficulty exporting their goods, as these goods are priced in their own strong currency and are therefore more expensive in nations with weaker currencies. Nations with weaker currencies will have an easier time selling their goods to nations with stronger currencies, as their goods are cheaper as a result of their weaker / lower value currencies.

Those nations blessed with surplus essential commodities (energy, food, minerals, etc.) will naturally tend to run surpluses with nations less endowed with tradable goods, and as a result, the nations running trade surpluses will end up with the lion's share of the gold and silver. This generates global "haves and have-nots," with all the attending sources of conflict: "our lead will take your gold."

We might also note that fiat currencies issued by the sale of sovereign bonds are not actually "backed by nothing": they're backed by the interest payments made on the bonds and the entirety of the nation's economic-political-social stability and productivity which guarantee repayment of the bond at maturity.

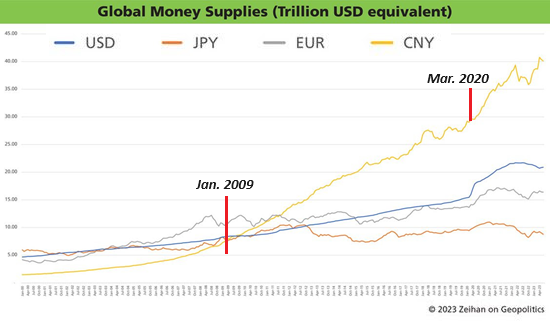

We all know the problem with fiat currency: the temptation to print more currency is irresistible, but ultimately destructive: once currency is issued in excess of the actual expansion of goods and services, the result is devaluation / loss of purchasing power, a.k.a. inflation. Here's a snapshot of global money supply:

In response, central banks are adding gold reserves: gold reserves are now larger than the reserves of the second-largest reserve currency, the euro:

Where does this leave us? Not with an easy answer, but with more complexities, starting with credit.

As David Graeber explained in his book Debt: The First 5,000 Years, credit has been an essential element of commerce from the earliest days of commerce, for very compelling reasons. How do we graft credit onto "money" when credit is itself a form of "money"?

We'll also have to consider the other crisis we face, soaring wealth-income inequality, which arose without restraint in ancient economies that used precious metals for money.

Looking at the history of Rome, we note that the wealth of Rome's elite in the Republic era has been estimated as 30 times the wealth of the average free male citizen, where by the Imperial era the elites had amassed fortunes 10,000 times the wealth of the average free male citizen. There was no fiat currency, so we must accept that politics is part and parcel of "money," social stability and economic vitality or stagnation.

We'll grind through these additional complexities in my next post. I discuss these issues with Richard Bonugli in a

new podcast: CHS on Gold and What Currency Systems Make Sense (31:37 min).

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Marty B. ($7/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Peter H. ($7/month), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Francoise L. ($70), for your magnificently generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Joe ($70), for your monumentally generous subscription to this site -- I am greatly honored by your support and readership. |