You Can Only Choose One: Cheap Oil or a Weak Dollar

September 25, 2017

When the price of oil rises to the point of pain, just remember the handy-dandy discount mechanism: a much stronger US dollar.

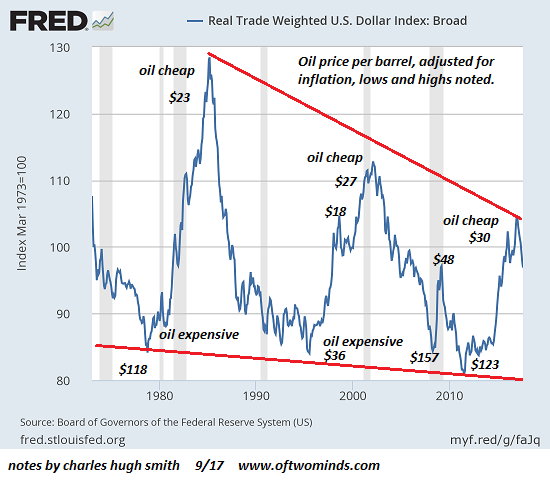

Glance at this chart of the trade-weighted U.S. dollar, and note the swing highs and lows in the price of oil per barrel around each peak and trough. You can look up historical inflation-adjusted prices of oil in USD on this handy chart: Crude Oil Prices - 70 Year Historical Chart (macrotrends.net)

The correlation isn't perfect, of course. Oil was relatively cheap between 1986 and 2003, due to a relative abundance of supply as Saudi Arabia and new fields ramped up production, with two periods of extreme price action: a brief spike higher in 1990 preceding the First Gulf War, and a collapse to $17 in the 1998 Asian Contagion financial crisis.

Geopolitical crises, wars and supply shocks will move oil prices regardless of the value of the USD. That said, it's clear that absent such shocks, there is a strong correlation between a stronger USD and lower oil prices (in USD of course) and a weaker dollar and higher oil prices.

The reason why is straightforward: if the dollar gains purchasing power against other currencies, it buys more oil for each dollar.

Conversely, when the USD weakens, its purchasing power declines and it takes more USD to buy an imported barrel of oil.

(Note that the price of domestically produced oil is largely set on the global marketplace. West Texas crude oil may be a few dollars less per barrel than Brent crude oil, but if the global price skyrockets, so does the price of US-produced crude.)

Since oil and gas are the essential resources of the industrial economy, the price paid by consumers and commercial users matter.

The one way the US can get an across-the-board global discount on oil is to push the purchasing power of the USD higher. That is an enormous benefit that few commentators ever mention. Instead, pundits talk about the benefits of a weaker dollar, which boil down to lower priced exports.

Which matters most to households and enterprises? A tiny blip higher in exports (a relatively modest slice of the U.S. economy) or lower energy prices at the pump?

If a recession were to pressure household budgets, the one sure way to lower household spending on oil/gasoline would be to strengthen the USD.

There are two basic mechanisms that strengthen the USD: raise interest rates, so global capital flows to USD-denominated debt to earn the higher yield, or a global financial crisis which causes global capital to seek the relative safe haven of the USD.

In a global crisis, liquidity and credit will dry up, and all those non-US debtors holding the $11 trillion in USD-denominated debt I mentioned on Friday will be scrambling for USD to service their debts. This will also increase demand for USD, pushing the USD higher.

The Federal Reserve insists that yields must remain near-zero or the economy will collapse. Americans paying 15% to 23% interest on their credit cards haven't seen any benefit from near-zero rates, nor have student-loan debtors. The real beneficiaries of low yields are financiers, banks and corporations which borrow immense sums for next to nothing. (Try finding a credit card with a 1% or 2% interest rate.)

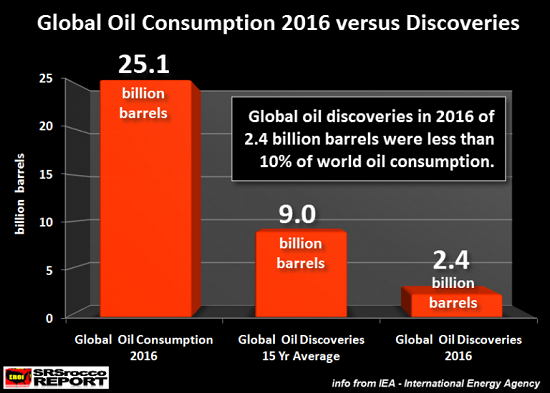

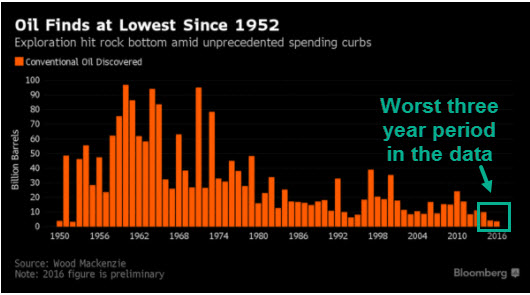

At some point, the price of oil might start mattering to households and businesses. Note that the discoveries of oil are now a thin slice of annual consumption. As the cheap oil is depleted, what's left is the costlier-to-extract stuff.

Even more alarming, the global supply of oil might fall well below global demand, and stay there.

When the price of oil rises to the point of pain, just remember the handy-dandy

discount mechanism: a much stronger US dollar.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

Check out both of my new books, Inequality and the Collapse of Privilege ($3.95 Kindle, $8.95 print) and Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle, $8.95 print, $5.95 audiobook) For more, please visit the OTM essentials website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Coins & Stuff ($10), for your splendidly generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, Darwin H. ($5/month), for your monstrously generous subscription to this site -- I am greatly honored by your support and readership. |

Discover why Iím looking to retire in a SE Asia luxury resort for $1,200/month. |